Have you come from another link / article about Retirement Solutions and ready to see what my business is? Click here.

One of the biggest mistakes in my life has been not planning my retirement solutions before it was too late.

Stupid as it sounds, I just didn't foresee how quickly the years would pass, and I didn't plan ahead far enough.

Think This Is Not For You?

Sorry – it's something you should think about before it's too late for YOU!

Whether you are….

- Close to retirement

- Already retired

- Nowhere near retiring

- OR you're planning early retirement

…..YOU can avoid making my mistake – or recover from it, as I am – even if you think you've missed the boat.

Why You Are NOT Planning Your Retirement Solutions

If you are like me these are some of the excuses I gave myself:

- There's still plenty of time to sort that out

- Heck – you do the lottery every week… your numbers could come up

- You're sure you'll have a successful business before you retire

- You can't imagine you will ever want to retire – you love what you do

- You have more pressing things to spend your money on

- Mistrust of pension companies

For me, that last one was well-founded. When my accountant finally persuaded me to start putting some money aside each month for a pension, I invested it with a well-respected and supposedly safe pension provider. The company subsequently went bust, taking most of my money with it.

I recovered some of it under a government compensation scheme – and of course there were people with far bigger losses than mine, and much closer to retirement. But it was a bitter pill to swallow.

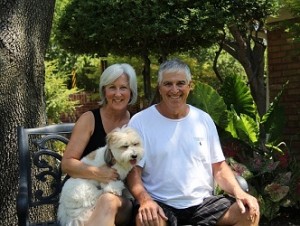

You might say “Ah, but there's more to being happy than money”. Dead right – but having money makes it so much easier to be happy. As my very wise Dad says:

You might say “Ah, but there's more to being happy than money”. Dead right – but having money makes it so much easier to be happy. As my very wise Dad says:

Luckily my offline business is still thriving and bringing me in a decent income to supplement my poor pension planning.

But even if you think (as I did) that you love your work so much you can't envisage ever wanting to retire – trust me, there will come a point when you want to spend more time doing the things you want to do, before it's too late.

But even if you think (as I did) that you love your work so much you can't envisage ever wanting to retire – trust me, there will come a point when you want to spend more time doing the things you want to do, before it's too late.

Families grow up so fast – I missed much in my own children's lives. I want to spend more time with my beautiful grand-daughters.

And selfishly, I want to still have the money to go on “good” holidays before my travel insurance costs as much as the holiday!

Costs vs Income Retirement Estimator

Have you ever have given much thought to how far your income will stretch after retirement? If not, here's a simple way to look in your crystal ball.

Have you ever have given much thought to how far your income will stretch after retirement? If not, here's a simple way to look in your crystal ball.

After the loss of my first pension I took out another private pension, but it was too late to build up a decent pension pot so – if I were relying solely on my pension income I would be in a sorry financial state. For instance:

- My monthly council tax costs more than the amount I receive for a week's pension

- My monthly heating and electricity bill uses up about 75% of a week's pension

- The holiday I have planned for later in the year is costing over 3 times my monthly pension income (excluding spending money and food!)

- My last car repair bill cost 3 weeks of pension income

- Thank goodness I paid off my mortgage some time ago! Have you?

To Make Your Own Retirement Estimator

I strongly suggest you obtain a pension income projection and compare your monthly out-goings to your expected income after retirement. If it doesn't look as if you are adequately planning for a comfortable retirement – or if you have already retired and struggling with your reduced income – it's never too late to make a change.

#RetirementSolutions: Making Hay While The Sun Shines Click To TweetTimely Planning For Retirement

One of the most obvious retirement solutions is that you should be saving hard for your retirement and – despite my own “lost the lot” experience – I still believe you should regularly put aside money for that inevitable rainy day:

One of the most obvious retirement solutions is that you should be saving hard for your retirement and – despite my own “lost the lot” experience – I still believe you should regularly put aside money for that inevitable rainy day:

- A big unexpected bill

- Redundancy

- Sudden down-turn in your business

- Or your spouse walks out on you without warning!

My ex-husband had an interesting philosophy to saving for retirement, and that was to focus on making more money to meet the bills, rather than adopting a scarcity mentality – scrimping and saving to reduce costs. I agree more with that sentiment now than I did at the time!

#Retirement Solutions: Hindsight is a wonderful thing! Click To TweetSo if you are lucky enough to have an existing income it's wise to take advantage of it as early as possible and start using some of it towards planning for your retirement.

What Will Make You Happy In Retirement?

Despite my Dad's tongue in cheek advice about being miserable in comfort, hopefully we all agree that there's more to being happy than just money.

Despite my Dad's tongue in cheek advice about being miserable in comfort, hopefully we all agree that there's more to being happy than just money.

What inspired this article was a very interesting radio program in the BBC Radio 4 “You and Yours” series.

It was based on a report prepared by the UK Office of National Statistics suggesting that, on average, people are most unhappy in their middle aged years (45 to 54), and this group experienced less personal well-being and higher anxiety levels than any other age group.

The report found that younger people and the over 65s were more satisfied with life than the “middle-aged” group. Presumably the “happy over-65s” they found had good retirement plans in place, which is becoming less and less likely in the prevailing economic climate!

The BBC wondered why the “middle ages” were so miserable and heard about these challenges from those ringing the programme:

- Job pressures – threats of unemployment / redundancy

- Financial problems and debt

- Realization that life is now more about loss than about gain

- Empty nest syndrome when “children” move out – OR –

- Family stresses when “children” can't afford to leave the family home

- Responsibilities caring for elderly parents

- Concerns about planning for retirement

- You feel that you've missed out on your dreams

The most miserable take-away message for me was that I'm apparently no longer “middle aged” – being over 54; does that make me “old”?

The most miserable take-away message for me was that I'm apparently no longer “middle aged” – being over 54; does that make me “old”?

Well – you're as old as you feel and I still feel about thirty, so I shall ignore that side-swipe!

But the program put a positive spin to all the woes of the middle-ages, because it invited listeners to share the retirement solutions they used to beat the misery. Suggestions included:

- Exercise – get those endorphins going, with the added benefit of improving your health

- Find a community – which could be the pub, the Church, or volunteering for a favorite charity

- Practice gratitude – for anything and everything: family, friends, health, just waking up to each new day

- Live in the present – what's past can't be changed. So forget the regrets; fears for the future may never materialize; live for today

- Take a new challenge – one lady had started studying to be a gold-smith! Others were looking to start a part-time business alongside present commitments so they would have a second income in place for later years

How To Have A Satisfying Retirement

It's never too early to start putting some of those tips in place, and I've already done several of them myself. Here are the steps I have taken for “me time”:

- Weekly yoga and dancing classes

- Meeting for a local book club (sometimes we even discuss the book we've read!)

- Gone back to Church and started to get involved with some of their activities

- And of course……

Starting An Online Business For Retirement Income

When I have more time on my hands my current spending levels are likely to go UP, rather than DOWN so I'm using an online business to bring in extra income for my retirement.

Here are two options I'm having success with:

- More effort required, but you can make money giving away business tools that EVERY online marketer needs.

- Can be completely passive – with long-term (3-5 years) profitability OR take action and see faster results. Shares involved, so be prepared for a little risk, but spread into very small chunks.

Option 1 – Long-term profits, long-standing option, still successful

I hate promoting online businesses. Do you?

I hate promoting online businesses. Do you?

Because I have a life (AND still work on my profitable offline business) I don't want to spend ‘forever and a day' producing my own products promo materials and even my own products.

So I'm promoting a “done for you” system round a Private Members Club. Each month we are allocated small stakes in exciting start-up companies and the club manages everything for us.

I pay an affordable monthly subscription and I can either sit back and just learn about the companies as they grow (one has quadrupled in size, another has launched on a stock exchange and doubled), or I can take a completely passive role.

Alternatively, if I want to build a business I have the option of earning an affiliate commission for introducing new members using ready-made videos produced by my team leader.

If that sounds attractive to you – click here to watch a video OR contact me about the share club

It's available in over 70 countries and accepts GBP, EU and USD.

Option 2 – Affiliate Marketing

You can give away free information and tools to help others start an online business and still earn commission if they make purchases. The tools available on the link below (free) are everything you need to start an online business – and people are paying hundreds of dollars a month for these tools. (Or quitting because they don't have them / can't afford them.)

Even if you are happy to continue paying for these essential tools (when they're available free above) you can make money giving them away to other people who DO want to save money.

Warning About Some Retirement Businesses

I can help you with the goal setting side of planning for retirement but I'm not a qualified financial advisor, and I do not give investment advice!

I can help you with the goal setting side of planning for retirement but I'm not a qualified financial advisor, and I do not give investment advice!

Only take financial advice about retirement solutions from a qualified and FCA regulated independent financial advisor. Here's the UK site to help you find a registered financial advisor. Outside the UK, please search for a similar organization in your own country.

Do your due diligence: changed pension regulations in the UK mean that scamsters are cold-calling people close to retirement age and conning them into taking out their pension pots to invest in “schemes” promising tempting returns that will never deliver.

Many have already lost their entire life-time savings to these scamsters.

If it sounds too good to be true, it probably IS too good to be true. “Get rich quick” is more likely to be “Get poor quick”.

Never invest more than you can afford to lose, and always take professional, independent advice.

Your Retirement Plans Please…

I'd love to hear how you plan to finance your retirement – and please share this post if you know anyone who still hasn't got their plans in order!

- Have you got your retirement solutions safely in place?

- Or are you wondering how you will cope? Emotionally and / or financially?

- Would you like to retire early?

- Or do you think you'll never be able to afford to stop work?

I will never give you financial advice and I don't need it either. My finances are handled perfectly well by a qualified IFA. However as I'm successfully bridging the gap between full-time self-employment to part-time self-employment, please don't hesitate to contact me for a no-obligation chat about your goals and things to do in your retirement. Or even just to chat about how you are preparing for a satisfying retirement emotionally.