As post-Christmas credit card bills hit the door mat, do you wish you had stuck to your spending plan better than the accusing bill proves?

You're not alone.

Sadly many people don't even have a spending plan. They just bumble on from month to month, putting off facing up to the problem until it's too late and debts have escalated to unmanageable levels with problems such as:

- Overdue bills increasing as interest charges are added

- Court summons if you ignore bills

- Black marks on your credit reference

- Stress for yourself and your loved ones

- Eviction from your home or repossession

Act now before any of this happens.

Make, and stick to, a spending plan.

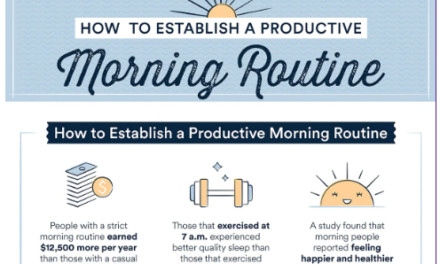

How To Make A Spending Plan

Simply take your income, deduct necessary expenses, and the rest is your spending money.

If your income is lower than your essential expenses, don't be tempted to top it up with loans and credit cards. Instead, think of ways to increase your income and reduce your expenses. A two-pronged attack.

What Is Your Income?

As simple as it sounds, the first thing to do is be completely aware of your disposable income. Some people think of their income as the salary quoted for their job, and live up to that level. But you should look only at your take-home pay after taxes, pension etc.

Freelancers have to work harder here because they will probably be paid pre-tax. If so, transfer the amount you will pay in tax straight to a savings account so that it's ready for when your tax bill arrives. Freelancers should keep their business and personal accounts separate. The tax man prefers that, your accountant's life will be simpler, so his bill will be lower. Pay yourself a ‘wage' from your business account into your personal account, and consider that as your income, not the amount you bill clients.

Consider ways to increase your income – a part-time job or business, sell something, rent out a room or garage. If you are on a low income are there any “benefits” you can claim for?

Or are you just over-spending?

What Are Your Expenses?

There will be the obvious necessities of life: a roof over your head, healthy food, water, heating, lighting, transport to work, taxes, paying off debts. Beyond that – consider everything else as a non-essential luxury.

That might seem harsh, but if you have debts, your top priority is to clear them as they'll almost certainly be accruing interest. Talk to the credit agencies holding your debts to see how best you can consolidate, freeze and repay them. Pay off debts before saving, as the interest you'll earn on savings is derisory compared to what you'll be charged on loans.

The best way to quantify your expenses is from previous bank statements and credit cards. Go through every transaction and classify it as necessity or luxury. Write down all cash transactions for a week.

‘Luxury' expenses you may consider cancelling or reducing are:

- TV / music subscriptions – there are many ‘free to air channels', and plenty to watch online.

- Takeaway meals and eating out

- Ready-made fast-food – almost always more expensive and less healthy than food you prepare from scratch

- Can you take a home-made sandwich to work instead of buying one from the shop?

- Nights out drinking – it's more economical to buy your drinks in the supermarket, and safer because of drink-driving laws (but don't increase your alcohol consumption because you don't have to drive!)

- Can you walk to work, or is it cheaper to take public transport instead of driving?

- If you have an expensive car on finance, can you switch to a better deal or a car with lower fuel consumption?

- Instead of buying new clothes could you ‘refresh' clothes already in your wardrobe with accessories. Find a charity shop in a ‘smart' area – you may be pleasantly surprised by the quality of goods others discard. Snap up the bargains.

- Gifts – are you just keeping up with the Jones, buying expensive gifts for family members? You may find a very warm reception if you suggest to family and friends that you ALL have a sensible cap on the amount you spend on gifts. If you agree to this, stick to it, and if anyone breaks it – don't be afraid to remind them!

- Impulse buys – do you really need that new gadget? Sleep on it before pressing the Buy button. Or imagine yourself explaining to a loved one why you bought an xxx when it would have made more sense to pay off a bill.

For more tips on creating a budget click here.

How To Stick To Your Spending Plan

- Reduce the limits on credit cards – or cut them up!

- Pay ‘necessity' bills immediately your income arrives, by standing order.

- Think very carefully about whether you are buying something you ‘need' or something you ‘want'.

- Translate the price of an item into the number of hours you had to work to earn that money.

- If you find yourself without money for the food shop, look in your cupboards. You may find there's enough accumulated to use up, shopping only for fresh milk / vegetables.

- Talking of food – vegetables are cheaper than meat – and better for you. Think of meat as a ‘treat' rather than an essential.

- Shop online for food to avoid impulse buys as you're walking round. Buy ‘Own Brand' items rather than ‘Named Brand' – they are often indistinguishable, but cost less.

In Conclusion

Remind yourself that the aim of your spending plan is to stop loan interest increasing and pay off debts.

Only then should you think about putting an affordable amount into a savings account to draw upon in the event of large emergency bills, such as a car breakdown.

I hope these tips will help you make and stick to your spending plan.

You can find more budgeting advice when you click here,