On Monday 1st June 2020 I'm delighted to say that, as a member of our Angel Investing club, I received shares in my first IPO when Vulcan plc was listed on the London Stock Market. Read the announcement here.

This was confirmed by an email to me from the club:

We have pleasure in confirming the listing of Vulcan on the AQUIS STOCK EXCHANGE. Another landmark investment by your Club.

The placing and subscription raised gross proceeds of GBP746,500 at a placing price of 3 pence per share. The net proceeds from the Fundraising will provide general working capital and will allow the Company to continue to pursue its acquisition strategy. Market capitalisation at 3p is GBP6,978,250.

Vulcan plc listed on the stock market on Monday at a price of 3p giving me an instant profit of 112% on my allocation at 2.25p. Yes, that's a paper profit so far, although if I want to, I can sell them in July. But having seen the ‘Vulcan Company Profile' webinar for members, there's no way I'm selling them as I believe in the long-term potential of Vulcan. Check out their website here.

✅ Vulcan Industries Plc was established to develop a precision engineering group of companies,manufacturing & fabricating products for a global client base.

✅They operate on a buy and build strategy.

✅ They have already completed 4 acquisitions and are planning for 3 more.

✅ The first objective is to bounce back from the pandemic situation but they have already received new orders.Vulcan's directors are confident of their expectation to complete a number of value-enhancing acquisitions which will generate significant synergies and further growth in the coming months.

What Is An IPO?

I'm still very much a learner in all this angel investing and business terminology, so I'll turn to Barclays plc to explain ‘what is an IPO' better than I can.

Suffice it to say it's very rare for a tiny investor such as I am to get the opportunity to share in a stock market listing. You'd normally expect to invest thousands – if you ever got to hear of it at all.

It was only my angel investing share club membership that gave me this opportunity.

The Share Club?

The club, which is accessible in most countries of the world, was founded in 2015 with these aims:

- Make money for its members from the long-term growth of shares purchased in the early stages of innovative companies. Its target was 20% per year, so far it has achieved 25% per year.

- Allow members to learn about the workings of real-world business – you don't have to participate, but it's an education into the real world of business as opposed to the sometimes ‘wishful thinking' of online business.

- In ‘company profile' webinars members can engage with and question the entrepreneurs who own these companies.

- Protect the interests of members by holding their shares in nominee accounts independent of the club.

It's kind of crowd-funding, but with the club taking an active role and oversight in the management of the companies within our portfolio.

Short-term Income

You'll see above that the club membership is about long-term share growth.

Additionally, those members who choose to introduce other members can be rewarded from the affiliate scheme but that's 100% voluntary, and most don't bother with that side of it. I had no intention of finding other members when I first joined the club. It was just intended to be a side-line savings plan (better than the bank!) but two things happened:

a) I was impressed and interested by what was offered within the club

b) I realised the amount of support offered free of charge by my team leader who makes videos and websites for us, to help us explain the club. (You'll see an example later.)

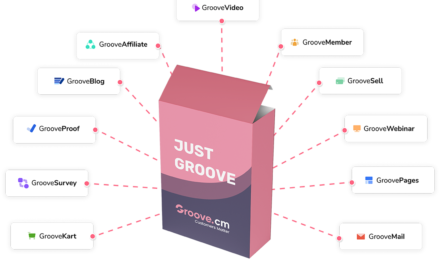

What Shares Do I Own?

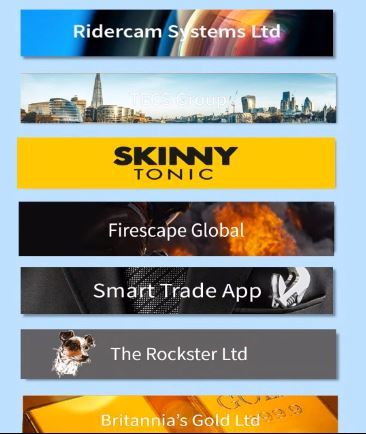

I have shares in 14 different companies. Here are just a few of them. You can learn more about them by scrolling down an informational site prepared by my team leader. this also gives you access to more detailed information within the club as a free member, with NO obligation to make any payments.

Click here to learn more about the club.

- Skinny Tonic is already a best seller on Amazon and can be found on UK supermarket shelves

- The Rockster is a premium healthy dog food, poised to launch in the USA after the currently prevailing COVID-19 pandemic. The story of the Rockster – real dog – is heart-warming (although sadly he died just a few days ago, after a long and happy life).

- Ridercam lets roller coaster theme park riders buy a video of their ride when the ubiquitous ‘selfie' would be a danger to other riders.

Don't take my word for it – look at the companies yourself – the common theme is that they are all small companies trading profitably and working towards growth and ideally stock market listing, or at least a take-over by one of the giants of their industry. And I couldn't have afforded, or been able, to invest in these other than through the club.

Having bought other shares myself many years ago in the conventional manner, through a broker, anything less than £1,000 investment per share meant that the costs ate up most of the profits. So there's no way I could have risked / spent £14,000 to invest in the companies above. Instead, my investment has averaged out at a little over £150 per month for about 6 months and I have stakes in 14 profitable companies. (My outlay has been higher than the minimum investment as I took advantage of some special offers.)

I'm NOT going to quote profits because of all the usual disclaimers, and the fact that it's still a paper profit that I'm hanging onto in the hopes of company growth.

So, this begs the question…..

Is Angel Investing Risky?

Of course there is always some risk with shares – nothing is guaranteed. But if I go out in a car there's no guarantee some maniac won't take me out at the traffic lights at the bottom of my road. Even tomorrow morning isn't guaranteed. My approach to any business is managing risk, and never letting my stake exceed what I can afford to lose.

As I've explained above my investment in each of the 14 shares is minimal. For example an 89EU monthly subscription would typically be split between 4 shares chosen by the club, depending on their current activities. I can choose to invest in other companies inside the club's internal market place where members can buy and sell their shares. I've only done this to buy shares in companies that were promoted internally before I joined, to diversify my holdings. For instance, as a dog lover, I bought maybe £50 w0rth of Rockster shares.

I made a purchase of their Christmas stocking offer. Oh – and I now get bonus share allocations for being a consistent subscriber for 3 and then 6 months. So although you can become dormant any time and retain your shares, it's worth staying loyal and picking up the special offers that come your way.

Interested In Angel Investing?

If you're interested in the workings of real-life business and fed up of the bank sitting on your cash and reducing already derisory interest rates, Angel Investing could be for you.

It's definitely NOT a get-rich quick, make money online, scheme. Shares in small companies are not easy to dispose of, so if you can't afford to set aside money for the long-term, this probably isn't for you. (Unless you're interested in the free affiliate program – contact me.)

To find out more, you can become a free member to look round the website and attend webinars. At the moment there's an offer of a 100EU share allocation for a random attendee on the Wednesday 6pm (UK time). Only about 120 members attend, so you have a good chance.

To become a free member and learn more about Angel Investing – click here. (PS If you're reading this in June 2020 there are more shares in Vulcan plc available to paid members at a discount to the price at which they listed on 1st June.)